how to file taxes for coinbase

If you sell or spend your crypto at a loss you dont owe any taxes on the transaction. Coinbase tax reporting begins by calculating your gainloss which is a summary of your transactions executed on Coinbase that ended in a gain or loss.

Pin By Piao On 品牌插画 Website Illustration Illustration Map

If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received.

. TIN and legal name used by Coinbase to file Forms 1099 with the IRS. Heres some good news for crypto taxes. The only form they still issue is 1099-MISC probably to streamline their tax services.

When required by the IRS the crypto exchange or broker you use including Coinbase has to report certain types of activity directly to the IRS using specific forms and provide you with a. Import txf file into Turbotax Desktop. The gain from selling off Bitcoins is capital gain absent some rather unique facts and whether it is long or short term depends on the holding period.

Even if you dont receive this form the IRS still holds you accountable for reporting your Coinbase activity. The Coinbase Card is powered by Marqeta. Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets.

Click the Generate report button. You can count on the IRS going back through your history. Regardless they give you the resources to get your tax information accurately.

Download your transaction history from Coinbase to view and file your statement so. Upload the file to. Follow these steps.

You can do your taxes manually by calculating your cost basis gains and losses. Go to the Reports page by clicking the user icon in the top header and click Reports. Import your transaction history directly into CoinLedger by mapping the data into the preferred CSV file format.

Taxes are based on the fair. Coinbase calculates capital gainslosses of every recorded transaction by subtracting the cost basis the price at which you bought or received your tokens from the. This video really focuses on how crypto taxes work on coinbase but the process could be applied to any crypto exchange or custodian as I show in the video with Celsius.

Even if you didnt receive a form your crypto trades must still be reported to the IRS. ⁵Coinbase doesnt provide tax advice. You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger.

Crypto mined as a business is taxed as self-employment income. File Import From Accounting Software Other Financial Software TXF file Continue Choose a File to Import Import now. Staking rewards are treated like mining proceeds.

Crypto can be taxed in two ways. This entire video will walk you through what you generally need to do to file your crypto taxes correctly. The crypto exchange company said in a blog post that a new section in its app and website would help customers.

Coinbase exports a complete Transaction History file to all users. If you bought 10000 in Bitcoin and sold it for 13000 for example your taxable gain would be 3000. Create a csv file with all transactions using the format shown at Easytxf.

This is what youll see. CoinLedger automatically generates your gains losses and income tax reports based on this data. IRS has not issued real clear guidelines on the types of income that should be reported it does specify in this link A taxpayer who receives virtual currency as payment for goods or services must in computing gross income include the fair market value of the virtual currency 3 measured in US.

The Coinbase Card is issued by MetaBank NA Member FDIC pursuant to a license from Visa USA. Simply follow the steps below to get your public address and your tax forms will be ready shortly. If youd rather avoid the Coinbase tax report API you can download the CSV file of your Coinbase trading history using the steps above.

You only owe taxes if you spend or sell it and realize a profit. Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history. If you are a big fish I would make sure to pay the taxes.

So if you need to do your crypto taxes this entire video will walk. Connect your account by importing your data through the method discussed below. If you meet certain requirements discussed below you can get the form directly through Coinbase.

Information here is provided to help you understand your taxes but should be reviewed before you use it to file your taxes. You can also upload a CSVExcel file instead of connecting your account with the public address by following the steps explained below. The last option is to manually add transactions one by one from the Transactions page.

Coinbase no longer issues 1099-K or 1099-B for its traders as of the 2020 season. Keep in mind that the IRS and Coinbase are currently in a disagreement about whether or not Coinbase needs to turn over all major data about its users. Answer 1 of 3.

Coinbase wants to help customers file cryptocurrency taxes for the 2021 tax year. Prescribe what information is needed to resolve the B-Notice. The Coinbase tax report API is read-only so you dont need to worry about another app having access to your Coinbase account.

If you purchased the Bitcoins you have a cost basis if you mined them yourself. Plus 10-15 on gains isnt that bad IMO. How to File Crypto Taxes with Coinbase How to Do Crypto TaxesHow to Pay Crypto Taxes in the USDoes Crypto Get TaxedHow Crypto Taxes Work on Coinbase FULL G.

Dollars as of the date that the virtual currency was. You can request a 1099 form to complete your taxes. Used Easytxf to convert the csv file into txf file.

Click Generate Report for CSV report and click Download when the file is ready. Please work with a professional. Leave the default settings All time All assets All transactions or specify the report you want.

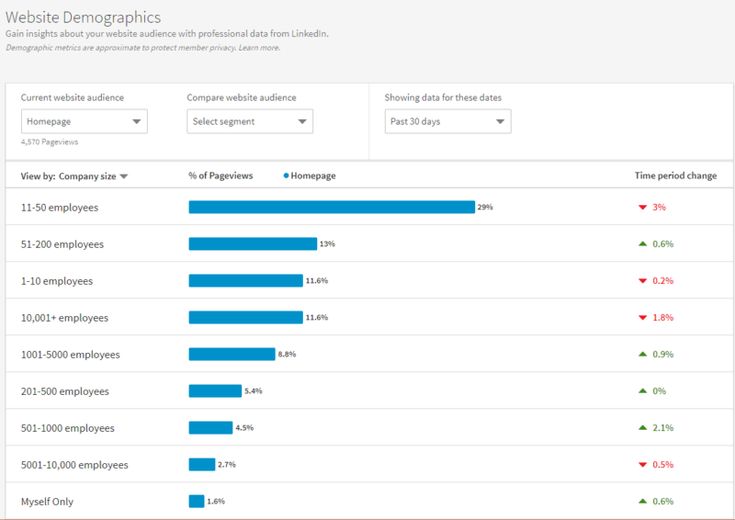

How To Make The Most Of The Demographics Of Linkedin S Free Website Free Website Demographics Business Website

Cryptocurrency Tax Tips Until Tax Relief Passes Expert Blog Crypto News Bitcoin Regulation Coinbase Cryptocurrency Cryptocurrency News Bitcoin Mining Software

Pin On Small To Medium Business

Cryptocurrency Exchange Coinbase Introduces A New Tax Calculator Cryptocurrency Trading Cryptocurrency Calculator

Financial Secrets Of The Wealthy Find Out Where Millionaires Put Their Money Bad Credit Paying Taxes Road To Riches

Coinbase Insta A Sus Usuarios A Pagar Impuestos Sobre Ganancias En Bitcoin Filing Taxes Income Tax Tax Brackets

Wealthsimple Smart Investing Investing Money Money Saving Strategies Money Strategy

Cartesi Is Now On Coinbase Earn Earnings Cryptocurrency News Bitcoin Currency

Here Is Your Sign To Pick Up A New Read From Your Local Bookseller Besides Being A Fantastic Way To Esca Book Recommendations Content Creation Body Positivity

Product Hunt Launches Digestion Application Of New Techniques Without Spam Sip Digestion Product Launch Application

Coinbase Lets You Buy And Sell Usdc Stablecoin Techcrunch Cell Phones For Sale Techno Gadgets Buy And Sell

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service In 2021 Filing Taxes Bitcoin Account Coins

Coinbase Est Desormais Votre Guide Personnalise Des Taxes Cryptographiques Par Coinbase Janvier En 2022 Personnalise Chef De Produit Investir En Bourse

Coinbase Learn How To Set Up A Crypto Wallet Youtube In 2022 Learning Wallet Setup

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service In 2021 Filing Taxes Bitcoin Account Coins