michigan property tax formula

Computing real estate transfer tax is done in increments of 500. When comparing Michigan real property tax rates its helpful to.

How Much Does Your State Collect In Property Taxes Per Capita

145 average effective rate.

. A series of individual ad valorem tax levies fixed dollar levies called special assessments an optional collection fee. A Michigan property tax bill consists of three basic parts. The inflation rate adjustment for this years property taxes in Michigan is 33 less than a maximum 5 allowed under Proposal A but it is the highest it has been in about 15.

Get In-Depth Michigan Property Tax Reports In Seconds. Ingham County contains most of the state capital Lansing and has one of the highest property tax rates in the state of Michigan. So if your home is worth 200000 and your property tax rate is 4 youll pay about.

Ad Our Property Tax Records Finder Locates Local Records Fast. On the other hand Michigan homeowners are protected from. The Millage Rate database and.

Multiply the amount by 20. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Michigan State Tax Quick Facts.

Taxes in Michigan. The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

New data released on Wednesday showed shelf stock rates for. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

Kent County collects on average 156 of a propertys assessed fair market. Counties in Michigan collect an average of 162 of a propertys assesed fair. The median property tax in Kent County Michigan is 2296 per year for a home worth the median value of 147600.

16 hours agoNow infant formula production has rebounded but it can still sometimes be a struggle for parents to find it. Start with the amount of taxes that will be charged on your home for the current tax year if you are an owner or the amount of rent you paid for the year. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

Simply enter the SEV for future owners or the Taxable Value. The average tax rate in the state is 1632 percent and the average property tax invoice is a cool 4080 in 2019. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

The average effective rate including all parts of the county.

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Michigan Property Values Citizens Research Council Of Michigan

Michigan Property Tax Calculator Smartasset

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19631901/Screen_Shot_2020_01_27_at_10.12.12_AM.png)

How To Read And Appeal Your Detroit Property Tax Assessment Curbed Detroit

How To Calculate Property Taxes

Tax Information Tuscola County

State Tax Levels In The United States Wikipedia

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

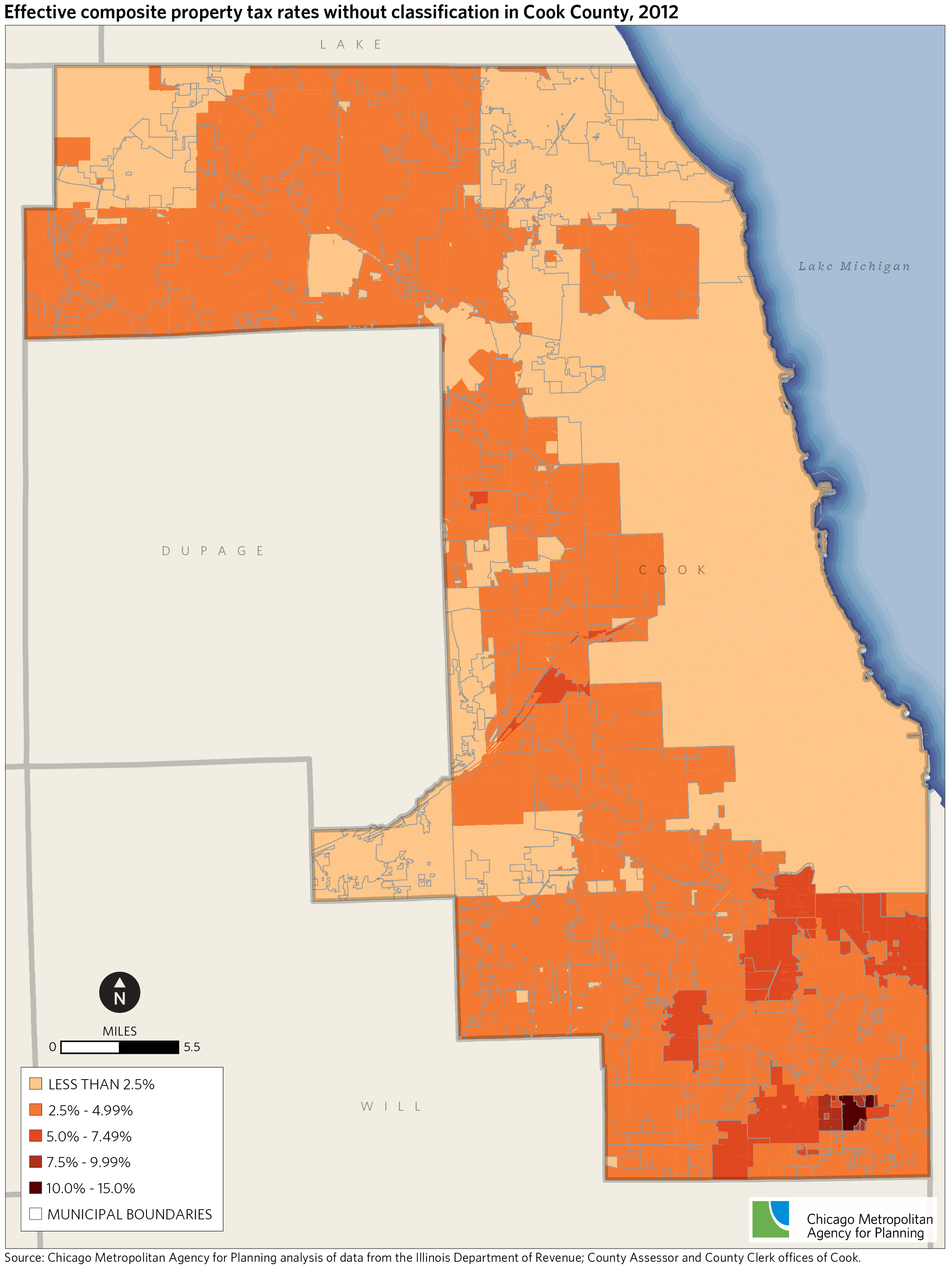

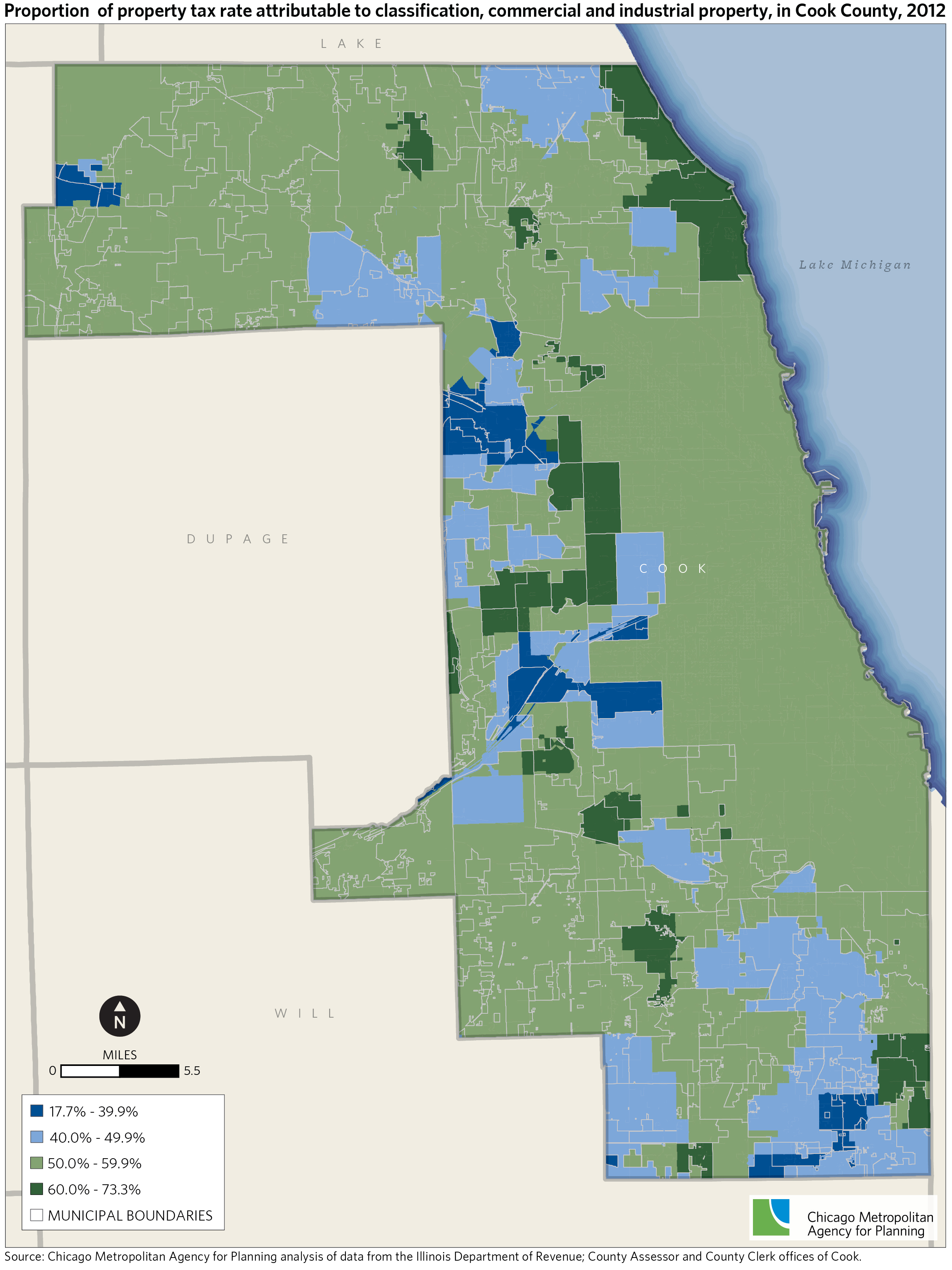

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc